LET’S TAKE A LOOK AT THE INS AND OUTS OF PROPOSITION 60/90

BY SALLY LEE

HOW DOES PROPOSITION 60/90 WORK?

When you purchase your home you pay about 1.25% in property taxes.

Over the years the assessed value goes up, therefore property taxes go up. Thanks to Proposition 13 the assessed value cannot increase more than 2% annually. Therefore, your current property taxes are lower than what someone would be paying if they purchased your home now.

Proposition 60 allows you to continue to pay those same taxes when you purchase a home of equal or lessor value within the same county. Proposition 90 came after and now makes it possible for you to move to other participating counties. (see #2 below)

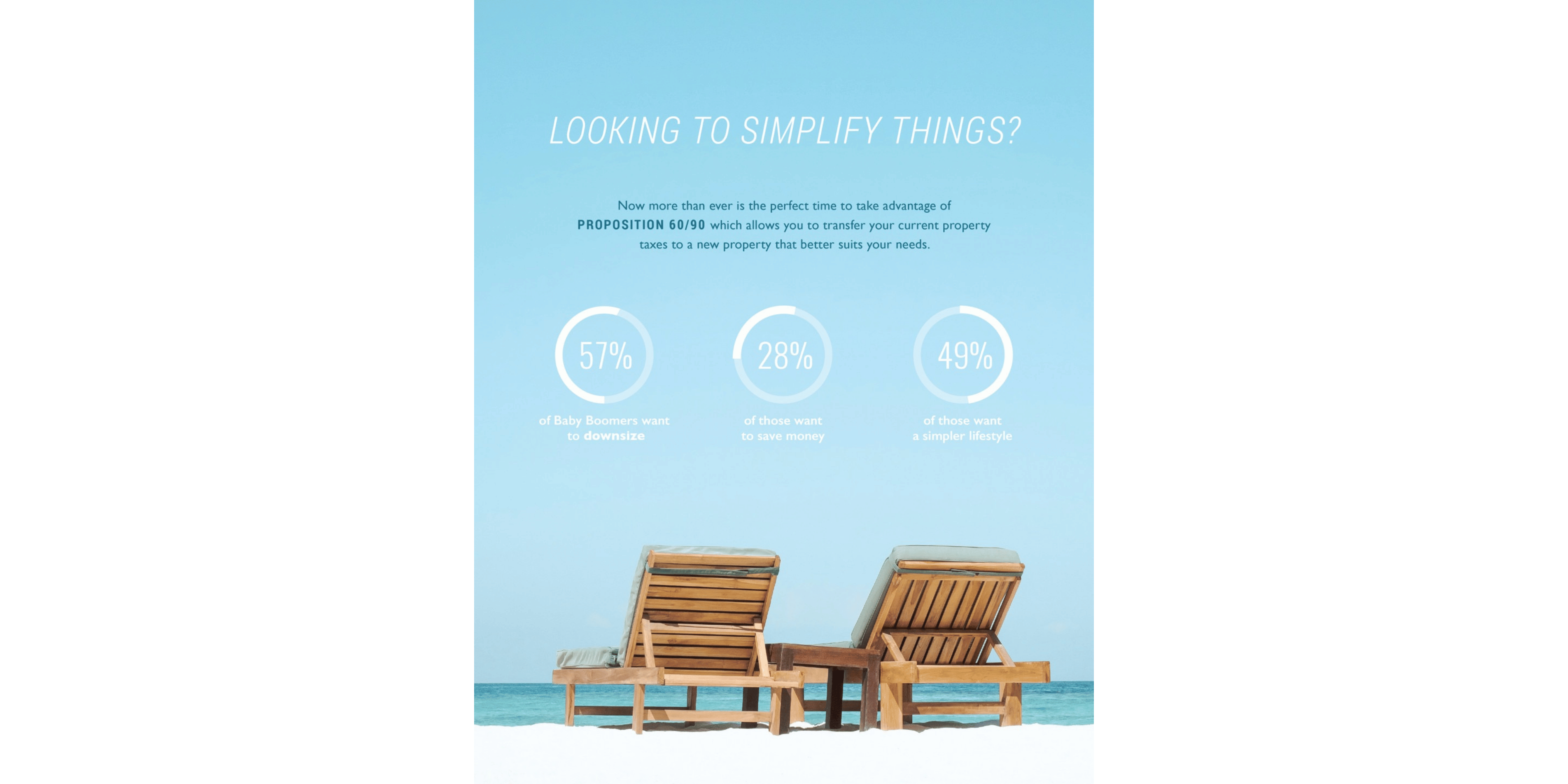

This results in thousands of dollars of savings, making it more possible and comfortable for you to downsize and simplify your life, save money, and start your next chapter.

PROPOSITION 60/90 REQUIREMENTS

You or your spouse must be at least 55 years of age when selling the original property.

The original property and new property must be within participating counties (Alameda, El Dorado, Los Angeles, Orange, San Diego, San Mateo, Santa Clara, Riverside, Ventura and Santa Barbara).

You can only use the transfer once in a lifetime.

The new replacement property must be of equal or lesser value than the original property sold.

The new property must be bought or built within two years of the original property’s sale.

Your original property and new property must be your primary residence and have been eligible for the homeowners’ exemption or disabled veterans’ exemption.

Leave a Reply